Bitcoin price managed to rise above the $5,000 mark in trading today, fulfilling the expectations and predictions of a number of Bitcoin faithful. However, it has also led to widespread concerns that a bubble is forming that will eventually crater the portfolios of many investors.

The massive rise is difficult to grasp, without considering what the value of what an investment would be had it been purchased last year.

Consider an average investor who purchased $100 of Bitcoin in September 2016 when Bitcoin was selling for $572. Had they managed to hold the currency through all the ups and downs of the last year, they would be sitting on $850 with today’s $5,000 price point.

Is there an easier way to turn a few hundred dollars into thousands?

Billionaires around the world have invested in bitcoin. Now you have the opportunity to become the next bitcoin millionaire; regardless, of the bitcoin price. <Learn More>

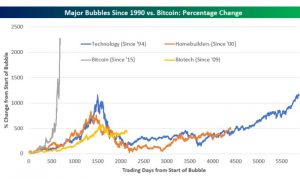

This fantastic level of value growth in a short time has led to wide speculation that Bitcoin is in a bubble. Consider Bloomberg’s analysis via Twitter:

While it is clear from the chart that the Bitcoin price has skyrocketed in recent months, pundits disagree with the bubble analysis. Industry leaders who are otherwise notoriously bearish have seen substantial growth potential for Bitcoin.

The argument is that Bitcoin was substantially undervalued until this recent run-up, and that the only thing that had limited its growth potential was increasing mainstream adoption.

New Satoshi Cycle?

However, as news of returns spread, adoption will certainly increase, leading to greater levels of investment and growth.

This cycle of adoption and growth leading to greater adoption and growth (termed a Satoshi Cycle) may well drive prices far higher in <Read More>

Gold prices

Gold prices