The US Senate Budget Committee has released its 2018 proposed budget for approval in the larger congressional body. The proposal will then be matched with the House proposed budget and worked out for final approval, before being sent to the White House.

The US Senate Budget Committee has released its 2018 proposed budget for approval in the larger congressional body. The proposal will then be matched with the House proposed budget and worked out for final approval, before being sent to the White House.

Senate 2018 Budget Adds $1.5 Trillion to National Debt

The Senate proposal contains provisions that will increase federal spending for this year, adding a jaw-dropping $1.5 trillion to the national debt over the next year. Committee members have suggested that the tax cuts would produce economic gains, which would offset the total debt spending.

After 2019, the proposed budget would begin to cut non-defense spending, resulting in substantial budget savings over the next decade. The goal of both the Senate and House proposals is to balance the budget in that time.

Getting Involved in a Bitcoin Club

Joining a bitcoin club is the easiest way to begin creating wealth. With as just a few hundred dollars, you can be on your way to joining the elite group of bitcoin millionaires. <Join Now>

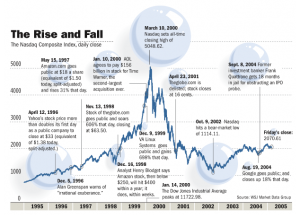

Bitcoin bubble?

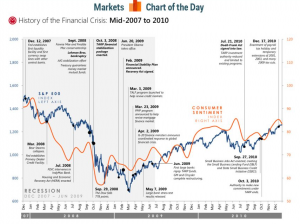

After recent comments by the Federal Reserve officers regarding trust in the government, the new budget seems more confidence-eroding than building. While the government can continue to print money and increase the national debt (now nearly $19 trillion), Bitcoin is held at a fixed supply.

Multiple analysts have pointed out that as long as Bitcoin continues to increase in use cases and liquidity, the price per Bitcoin will inevitably increase. <Continue Reading>

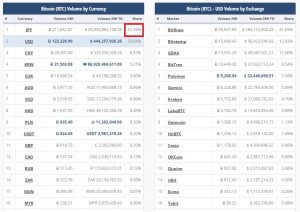

Japan Becomes Largest Bitcoin Market as Traders Leave China

Japan Becomes Largest Bitcoin Market as Traders Leave China