China is a Bitcoin powerhouse. An Article by Willie Tan in Cointelegraph recently concluded that 70 percent of Bitcoin mining is located in China. The Chinese have taken to Bitcoin like fish to water and there is no reason why they shouldn’t. China and Bitcoin are like a match made in heaven. Cheap computer hardware, ample hydroelectric power and cool environs all make China the right place for a Bitcoin mine to be located. Recently the 2017 Shape the Future Summit was held at the Hong Kong Grand Hyatt Hotel between Sep. 20, 2017 and Sep. 21, 2017. The event had invitees from 80 enterprises in the Bitcoin industry but the main highlight of the event was the release of the first ever Bitcoin Documentary in China.

China is a Bitcoin powerhouse. An Article by Willie Tan in Cointelegraph recently concluded that 70 percent of Bitcoin mining is located in China. The Chinese have taken to Bitcoin like fish to water and there is no reason why they shouldn’t. China and Bitcoin are like a match made in heaven. Cheap computer hardware, ample hydroelectric power and cool environs all make China the right place for a Bitcoin mine to be located. Recently the 2017 Shape the Future Summit was held at the Hong Kong Grand Hyatt Hotel between Sep. 20, 2017 and Sep. 21, 2017. The event had invitees from 80 enterprises in the Bitcoin industry but the main highlight of the event was the release of the first ever Bitcoin Documentary in China.

First Bitcoin Documentary – Shape the Future

2017 – Shape the Future is a documentary that charts the course of the world’s first digital currency, Bitcoin. The documentary produced by BitKan is supported by Bitmain, Huobi, Bixin and ViaBTC. It begins the story with how Bitcoin came into being and discusses the mysterious inventor of Bitcoin Satoshi Nakamoto. Just who was this man? Was he even a man or was it a group of men?

Shape the Future takes a uniquely Chinese perspective on the creator and the creation of the digital asset. Still, the question of who is Satoshi Nakamoto will perhaps forever remain a mystery. The film does explore the various possibilities and comes up with the usual suspects including Craig Wright. Xiaoxiao Sun, Bixin Operations Manager alludes in the documentary that the decision of Wikileaks to accept Bitcoin was what prompted Satoshi to evaporate into thin air.

Perhaps the most interesting comment on Satoshi in the documentary comes from BTC123 Founder Bill Mo who says, “Only when he (Satoshi Nakamoto) erased himself can BTC achieve the full decentralization.”

Getting Involved in a Bitcoin Club

Joining a bitcoin club is the easiest way to begin creating wealth. With as just a few hundred dollars, you can be on your way to joining the elite group of bitcoin millionaires. <Join Now>

Following the evolution of Bitcoin

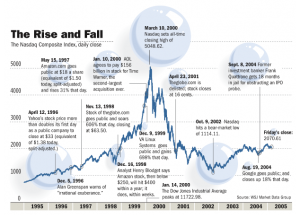

The film takes a course that follows the evolution of Bitcoin from its nascent era into becoming a mainstream tradable asset. The coming of the age of exchanges, <Continue Reading>

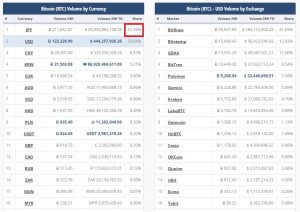

Japan Becomes Largest Bitcoin Market as Traders Leave China

Japan Becomes Largest Bitcoin Market as Traders Leave China