We live in crazy times, don’t we?

We live in crazy times, don’t we?

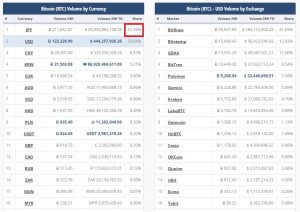

Bitcoin, a digital currency, founded in 2009 — and which, as the name suggests, is an electronic currency and cannot be held in a physical wallet — is just about the most valuable “currency” in the world and it has been so for a few years now. Given the circumstances, it’s only normal to question the credibility of Bitcoin. Because who, in the real world, actually believes that an electronic currency, created just about seven years ago, is truly worth more than a fiat currency. Say the British pound, that has been through several economic cycles over several centuries and is still here, right?

Image: tradingeconomics.com

Considering that the one British pound can only buy you 0.00032 BTC, it’s 100 percent okay for traditional investors, most of whose investments are valued in the British pound, US dollar and other fiat currencies, to think Bitcoin is a bubble. But the age of Bitcoin — that is, how long it’s been around — is the least of the reasons for that. Here’re some really popular ones.

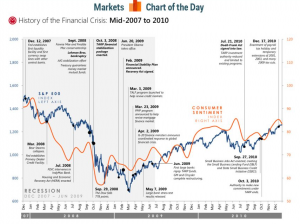

The financial crisis

The financial crisis

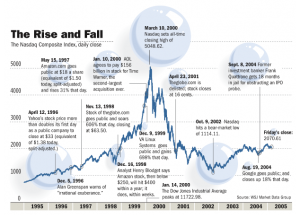

In the last two decades, we’ve witnessed two bubble busts. The dotcom bubble of the late 1990s and the housing bubble that led to the 2008 global financial crisis. For those who were affected by these two bubble busts, it was two wealth-eroding events in less than a decade. A natural response to such an unpleasant experience is defensiveness. After all, once bitten twice shy.

When comparing the assets that led to the dotcom and housing bubbles to Bitcoin, the odds are ridiculously against Bitcoin, at least, in the minds of traditional investors. That’s because, for the dotcom bubble, there were actual Internet companies that were, purportedly, building or selling products and services that people actually use. For instance, Pets.com, quite the most familiar flop from the dotcom bubble, was selling pet food and supplies, which people actually buy. <Continue Reading>

When comparing the assets that led to the dotcom and housing bubbles to Bitcoin, the odds are ridiculously against Bitcoin, at least, in the minds of traditional investors. That’s because, for the dotcom bubble, there were actual Internet companies that were, purportedly, building or selling products and services that people actually use. For instance, Pets.com, quite the most familiar flop from the dotcom bubble, was selling pet food and supplies, which people actually buy. <Continue Reading>

Getting Involved in a Bitcoin Club

Joining a bitcoin club is the easiest way to begin creating wealth. With as just a few hundred dollars, you can be on your way to joining the elite group of bitcoin millionaires. <Sign Up>

Japan Becomes Largest Bitcoin Market as Traders Leave China

Japan Becomes Largest Bitcoin Market as Traders Leave China