Interest is a subject with a very chequered history that today works hand-in-hand with inflation to control the world’s major economies. The story of interest is as old as that of money, but recently digital currencies have begun to add a major wrinkle.

Interest is a subject with a very chequered history that today works hand-in-hand with inflation to control the world’s major economies. The story of interest is as old as that of money, but recently digital currencies have begun to add a major wrinkle.

Once humans had invented currency to facilitate trade it became a common view that money effectively replaced the animals and cereal seeds for which it was exchanged and, therefore, should have similar properties of reproduction, i.e. increasing with time. This was all good and well as long as the currencies had the intrinsic value of the metals from which they were then minted.

Religious influences

Meanwhile, various religions emerged and moralistic clerics variously ruled against the charging of interest. It was described by its detractors as “usurious” and generally immoral; today, “usury” is only applied to excessive rates of interest. The principle of charging ordinary, non-abusive interest is commonly accepted.

Other religions, unfettered by qualms over interest, were effectively granted a monopoly in banking from which today’s monoliths grew. Along with these massive banks, the economies dependent on them continued to grow as well. Today interest is seen as an indispensable part of banking.

Something from nothing

The fact remains that interest is merely a way of creating “wealth” from nothing, certainly no productive process. And interest is naturally inflationary: it is often clearly visible that the rates charged by central banks generally match their local inflation rates, with inflation being the vital factor in the affordability of any long-term loan, the monetary value of which rapidly diminishes due to inflation.

This is an important point: long term loans such as mortgages are generally affordable because inflation will ultimately eat away the “real” cost of the monthly payment. A $1,000 monthly payment today will be much less, in real terms, 20 years from now. As long as you can afford your current mortgage payment, it should get easier to pay with time.

A recent (post 2008 crash) peculiarity of the banking system was the reduction of prime interest rates to around zero, followed by the innocuously named “quantitative easing.” This innocent term actually masked the wholesale printing of money, replacing that generated by interest, to support the perceived values of stock market while also supporting continued inflation at relatively low levels.

Importance to cryptocurrencies

What does this mean for digital currencies, which, unlike fiat currency, has no underlying interest rate? If anyone wants to lend Bitcoin or another such currency to somebody else, that’s between the lender and borrower.

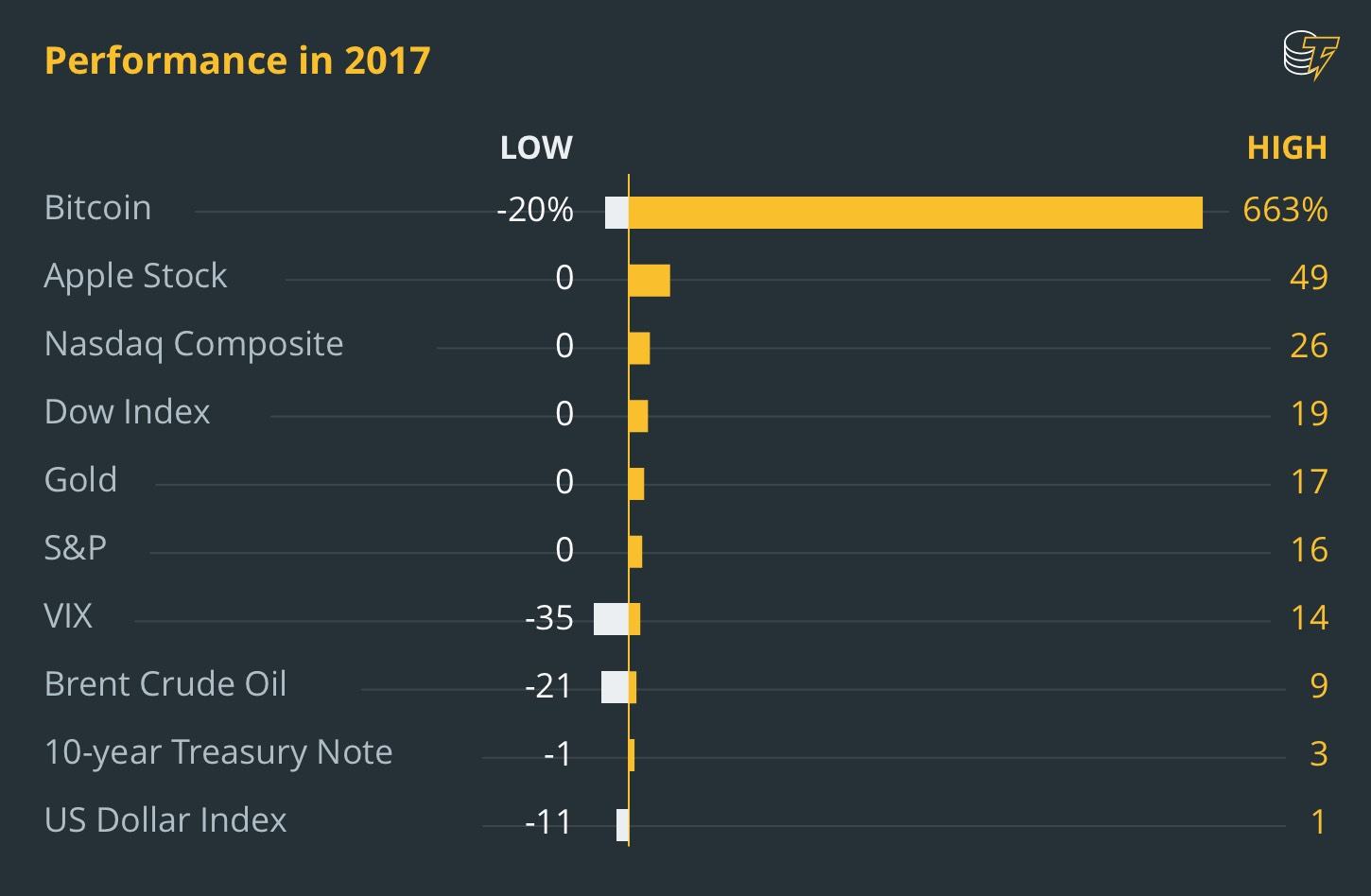

However, the nature of cryptocurrency is that, on the whole, its value constantly increases due to it being a finite resource – it cannot be created willy-nilly by a https://cointelegraph.com/news/bitcoin-may-change-it-all-brief-history-of-interest-inflationcentral bank. Another way of looking at it is this: as fiat money becomes less valuable due to inflation, digital currencies become more valuable relative to fiat ones.

This principle makes it difficult to justify “cashing out” one’s crypto holdings. When a deflationary asset (cryptocurrency) is sold to buy an inflationary one (fiat currency), it becomes far more difficult to buy back the digital currency that you initially sold. We’ve all heard stories about folks who sold Bitcoin a year or two ago to purchase mundane items, only to dearly regret it later. This implies <Continue Reading>

The Time is Now

Don’t miss the biggest opportunity of your lifetime?

Find out how…. free for 7 days. Take a look for yourself, then decide if you’d like to become a paid member.

Join Now!, It’s the easiest way to get involved in the fastest growing financial opportunity of your lifetime!

Only .015 BTC you’ll become a lifetime member of the club (you never pay another dollar from your pocket).

This is your chance! to get onboard with the elite group of bitcoin millionaires. <Join Now>

You have absolutely nothing to lose

*All Members start at 0.015 BTC (Level 1)

You’ll want to purchase 0.016 BTC

You can participate on multiple levels once your are activated.

Bitcoin (BTC) Calculator

Tim Draper has every reason to be bullish on Bitcoin as he has seen his $20 mln investment in the digital currency grow by over 1,000 percent in just three years. Draper is now predicting that in five years fiat will be so obsolete, it will be laughable.

Tim Draper has every reason to be bullish on Bitcoin as he has seen his $20 mln investment in the digital currency grow by over 1,000 percent in just three years. Draper is now predicting that in five years fiat will be so obsolete, it will be laughable.